Summary

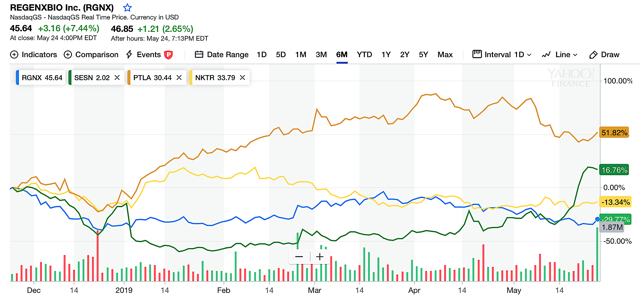

Bioscience stocks commenced the week on a rally with the momentum building stronger toward the weekend. Nektar, Portola, Sesen, and especially Regenxbio are trading northbound.

Packing heavy punches, Sesen Bio is knocking market bears toward an approval. Due to the robust VISTA outcomes, Vicinium will ultimately replace Valstar as the standard of care.

In readying for an upcoming approval of NKTR-181, Nektar formed the new subsidiary Inheris. It'll ensure a robust launch for NKTR-181, the silver bullet for the prescription opioid abuse epidemic.

Special thanks of all Integrated BioSci Investing members who participated in our daily discussion. I'm grateful for your intellectual generosity.

In honoring our troops who sacrificed their lives for our freedom, I'm offering a time-limited 50% discounts to new members. Message me if you wish to get your Memorial Day weekend gift.

You only have to do very few things right in your life so long as you don't do too many things wrong. - Warren Buffett

For the Memorial Day weekend, I'll feature another Integrated BioSci Investing Notable Community Discussion ("NCD"). This series is born out of my quest to continually improve the service for our community. As follow, an NCD fills in the gap for members who are unable to join the daily chat due to work and other obligations. As such, present pertinent highlights that we discussed during the week.

On Tuesday, May 21st, Flamman initiated an excellent discussion. As the market traded lower, the opportunistic investor Flamman - at least that's how I viewed him - prudently picked up shares in some key companies. Some of his purchases included the red hot Sesen Bio (SESN), Nektar Therapeutics(NKTR), and Omeros Corporation (OMER). Of note, I recently published updates on both Sesen and Nektar. You should definitely check out those research if you haven't done so. My trading analytics suggest that the momentum is building in Sesen, Nektar, Omer, and Regenxbio. These stocks have been trading on an uptrend earlier in the week.