To the maverick bio-investors,

At IBI, I focus on boosting all aspects of your life.

As you're now in New Year 2022, I want you to focus on the first and most important investment: YOUR HEALTH!

To the maverick bio-investors,

At IBI, I focus on boosting all aspects of your life.

As you're now in New Year 2022, I want you to focus on the first and most important investment: YOUR HEALTH!

I like the idea of using artificial intelligence because we're so short of the real thing. - Charlie Munger

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

The stock market is designed to transfer money from the active to the patient. - Warren Buffet

Figure 1: Aimmune chart (Source: StockCharts)

Figure 1: Aimmune chart (Source: StockCharts)You only have to do very few things right in your life so long as you don't do too many things wrong. - Warren Buffett

Figure 1: Achillion chart (Source: StockCharts)

Figure 1: Achillion chart (Source: StockCharts)

We always live in an uncertain world. What is certain is that the United States will go forward over time. - Warren Buffett

Figure 1: Atara chart (Source: StockCharts)

Figure 1: Atara chart (Source: StockCharts)Instead of engaging CD4 (helper T-cells), A-TCI primes CD8 (killer) T-cells with intelligence to improve these cells’ adeptness at detecting and destroying cancers and virus. Powering by A-TCI, Atara is growing a robust pipeline of immunotherapies. The partnership with Memorial-Sloan Kettering (MSK) also enabled Atara to deliver the next-generation mesothelin-targeted CAR-T (i.e. MT-CART).

Time is the friend of the wonderful company, the enemy of the mediocre. - Warren Buffett

Aside from his prowess for numbers, Warren Buffett has the excellent temperament for investment. In my view, Buffett's mega success is the cumulation of his hard work and rigorous learning. With a voracious appetite for knowledge, Buffett read financial report daily in his office. The man is a learning machine. That aside, the fact that Buffett lives in the golden land of opportunity also helps him grow Berkshire Hathaway (BRK) to become a multibillion-dollars franchise. In following the footsteps on the giant Buffett, I made it a habit to exercise my due diligence by researching every day and periodically reviewing my investment thesis. This learning process reinforces my growth and value investing approach that is adapted specifically for the life science industry. Over the years, I'm convinced that the Buffett wisdom - time being on your side when you hold a fundamentally sound stock - is true. As such, my pick on the oncology innovator ArQule (ARQL) exemplifies the Oracle's teaching.

Aside from his prowess for numbers, Warren Buffett has the excellent temperament for investment. In my view, Buffett's mega success is the cumulation of his hard work and rigorous learning. With a voracious appetite for knowledge, Buffett read financial report daily in his office. The man is a learning machine. That aside, the fact that Buffett lives in the golden land of opportunity also helps him grow Berkshire Hathaway (BRK) to become a multibillion-dollars franchise. In following the footsteps on the giant Buffett, I made it a habit to exercise my due diligence by researching every day and periodically reviewing my investment thesis. This learning process reinforces my growth and value investing approach that is adapted specifically for the life science industry. Over the years, I'm convinced that the Buffett wisdom - time being on your side when you hold a fundamentally sound stock - is true. As such, my pick on the oncology innovator ArQule (ARQL) exemplifies the Oracle's teaching. Figure 1: Arqule stock chart. (Source: StockCharts)

Figure 1: Arqule stock chart. (Source: StockCharts)

You only have to do very few things right in your life so long as you don't do too many things wrong. - Warren Buffett

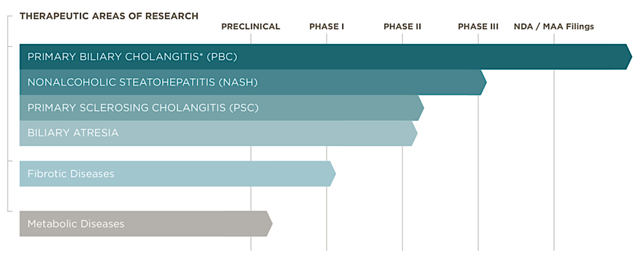

Figure 1: Intercept chart (Source: StockCharts)

Figure 1: Intercept chart (Source: StockCharts) Figure 2: Therapeutics pipeline (Source: Intercept)

Figure 2: Therapeutics pipeline (Source: Intercept)