Summary

Profitable investing can be done through studying fundamentals. Balancing risks versus returns is a requisite to successful investing.

A combination of index fund and high yield equities can be a prudent approach for the everyday investors.

A professional manager is most likely to profit more from the higher risks and higher rewards by building an all equities portfolio.

The “home-run” approach features a diversification into potential multibaggers (stocks yielding over 10X profits). And, the minimizing-losses strategy offers greater safety yet less rewards. We take a hybrid approach.

Despite its high volatility, bioscience stocks offer substantial profits for investors in the long run.

The true investor scarcely ever is forced to sell his shares, and at all other times he is free to disregard the current price quotation. He need pay attention to it and act upon it only to the extent that it suits his book, and no more. Thus the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage. That man would be better off if his stocks had no market quotation at all, for he would then be spared the mental anguish caused him by other persons’ mistakes of judgment. - Benjamin Graham

Due to subscribers’ demand, we continue the series on investment strategy and portfolio allocation. Vandon Duong recently joined Integrated BioSci Investing (“IBI”) and the young phenom will share his approach in this research. Accordingly, we’ll provide a general overview of our approach. Then, we will further expand on several topics of interest, particularly those indicated by our subscribers and the comments, in subsequent articles. The scope of this series is to share in-depth strategies for successful investing. The information presented here should be interpreted as advice to supplement the reader’s own strategy. Of note, every individual has unique circumstances and thus will adopt different approaches. Regardless of one’s circumstances, investment resources like IBI can be used to build a foundation of knowledge and aid in your own due diligence efforts.

Integrated BioSci Investing

We operate under the presumption that it is entirely possible to build wealth in a sustainable manner through insightful investing. The basis for insightful investing lies in studying fundamentals and balancing risks to returns. At the most basic level, one’s capital allocation can be divided into index funds and individual stocks. An index fund (e.g. mutual fund, ETF) is a single collection of securities, often individual stocks of a particular type. An index fund is considered a less risky investment because, as a collection of securities, it provides economies of scaleand diversification. There are many other securities (e.g. bond) available but these will not be covered in this article.

It’s important to fractionate one’s capital into two pools of either index funds or individual stocks. The pool consisting of index funds is considered low risk and unlikely to yield high returns. Benjamin Graham referred to the aforesaid index fund as the cornerstone of conservative investing. In contrast, the pool consisting of individual stocks is considered high risk and likely to yield high returns. And, these arsenals should be part of what Graham referenced to as the enterprising investors.

The purpose of this dichotomy is to identify one’s tolerance to risk and partition capital accordingly. For example, an everyday investor with an appreciation for risk could divide his/her capital into 60% index funds and 40% individual stocks. In another example, a hedge fund manager (i.e. the enterprising investor) anticipating exceptionally high returns could invest in 100% individual stocks. It’s important to acknowledge that while index funds are less risky compared with individual stocks, any security has a non-zero probability of collapsing (i.e. zeroing out).

Interesting, we also advised investors on allocating a good amount of cash to anticipate for a recession (the best opportunity to purchase stocks), which is another requisite to successful investing. Hence, we recommend investors to check out that research.

Strategy for Picking Winners

We’ll use the word “game” and “strategy” synonymously. That being said, the game of picking winners is a common theme among many competitions (e.g. Horse Racing, Fantasy Football, March Madness). In stock trading, the game of picking winners consists of building and optimizing positions in a portfolio. We consider a “winner” to be a stock which yields a return of at least the principal, but ideally much more.

Consider a hypothetical portfolio with 10 positions in a variety of high risk, high return biopharma stocks. Suppose that all but one position zero out. The single remaining position must yield a return of at least 10x to breakeven. Of course, one should utilize a more intricate strategy to do better than breakeven. The breakeven point is simply a good reference to have in mind (adjust portfolio expectations commensurate with the individual’s preferences and experiences).

There are two general approaches to building, for example, a 10-position portfolio: (1) home-run and (2) minimizing-losses (yet another dichotomy!). In the home-run approach, each position should be chosen such that it has the potential to offer returns much greater than 10x (>>10x). Often, these positions are stocks of biopharma startups chasing after extraordinarily high-impact healthcare solutions. Alpine Immune Science (NASDAQ:ALPN) is good candidate. These positions tend to also have the highest risk of zeroing out. The home-run portfolio will likely have at most one, if any, position as a winner.

Alternatively, one may build a portfolio following the approach of minimizing-losses; each position should be chosen such that it is unlikely to zero out. This approach requires greater due diligence, as it’s challenging to determine which biopharma startups will survive/thrive. Yet, as building confidence in a position requires more data analysis and time, it’s probable that the game of picking winners falls to acquiring comprehensive knowledge and having an edge over the rest of the market. That being said, we take a hybrid approach which rests squarely between home-run and minimizing losses.

30-Position Equities In IBI Long-Term Portfolio

Asides from the aforementioned highly concentrated (10-equity portfolio), a good alternative is to employ the 30-stock portfolio (to further distribute the risks while optimizing the rewards): this is the underlying basis of the IBI Long-Term portfolio. In distributing one’s capital in a larger number of stocks, we maximize the chances of finding multi-baggers or home-run equities. Concurrently, we distribute the binary risks further among many different stocks. That way, several negative binaries won’t affect our overall returns (as shown in table 1).

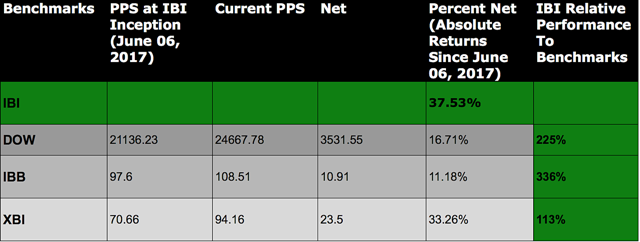

Table 1: IBI Long-Term portfolio performance (Source: Dr. Tran BioSci)

Interestingly, the aforesaid portfolio can be leveraged by both professional equities managers as well as everyday investors. For the everyday investor, one can build $1.0K in each stock for an overall $30.0K holding. If one has $60.0K, a distribution of $2.0K into each stock is prudent. Notably, we suggest that you read this prior research for further allocation insight. For these type of articles, we placed them under the “getting started” section in the marketplace for your viewing convenience.

Bioscience Stocks

It is quite rare to witness the phenomenal profits that the bioscience sector yields elsewhere. Since our inception back on June 2017, the IBI Long-Term portfolio yields over 37% (which outperformed all indices for the similar period of comparison). And, we hope to continue our trend.

What enabled such a robust performance are due to various factors. One, small-cap biosciences (despite its high volatility) tend to offer the best returns (if one has the stomach to absorb such wild fluctuations in the share price). The high returns stem from the fact that an approved branded therapeutic (especially those servicing the orphan market) can be reimbursed with a significant premium: those profits are then rippled to the share price (at least in the long-run). Second, we leverage on our expertise in data forecasting and years of experience in the financial markets in an integrated framework of investing to give our members an edge (especially in clinical and regulatory binary forecasting). Even if the sector performs superbly, it does not pay off if one does not have an edge and is simply going in for a coin toss per se.

Conclusion

In all, we hope you enjoy our continuing coverage re portfolio management and investment strategy. In this paper, we discussed the strategies that can be employed by both the professional managers as well as the everyday investors. The secret sauce for success is the balancing of risks to rewards (just as a physician would prescribe a medicine that is based on the benefits to risks profile). Finding one’s risk tolerance and adopting the proper strategy in building one’s portfolio is most likely to lead to long-term outperformance. In the goal of maximizing the chances of finding home-run (multi-bagger) stocks while minimizing the impact of the negative binaries, one can either employ a 10-equity portfolio or the 30-stock holding. The key is that diversification is a requisite. At IBI, we continue to push our due diligence in serving our members. We appreciate your stock tips, advice, wisdom as well as friendship. And, we hope to serve you for many years to come.

Author’s note: this research is authored by Dr. Tran BioSci Analyst, Vandon Duong (in collaboration with Hung Tran, M.D., M.S., C.N.P.R.). Disclosure: Dr. Tran is long on ALPN.

Vandon is a new analyst joining Integrated BioSci Investing. Vandon is a Ph.D. candidate in the Dept. of Bioengineering at Stanford University. He is also a Partner of the Mythos Biotechnology Fund, an investment firm composed of Stanford students and postdocs. Before joining Stanford, Vandon received his degrees in Physics and Biomedical Engineering from the University of Minnesota. Vandon has extensive research experience in protein engineering, leading projects involving directed evolution, structure-guided rational design, and design by computational modeling. He has expertise in biochemistry, bioengineering, and biophysics.