Summary

Atara recently published excellent tolerability data for ATA-188 at the 5th Congress of the European Academy of Neurology (EAN) in Oslo Norway.

In 2H2019, the company will deliver initial efficacy results for the first cohort taking ATA-188.

That aside, the firm will report Phase 3 results for its lead franchise tab-cell this year. The positive outcomes will erase doubt and fear regarding the departure of senior management.

Looking for more? I update all of my investing ideas and strategies to members of Integrated BioSci Investing. Start your free trial today »

We always live in an uncertain world. What is certain is that the United States will go forward over time. - Warren Buffett

In my view, a copycat drug usually procures meager sales. By the time a biosimilar comes to the market, a legion of "me too" therapeutics already decimated the profit margin. On the contrary, the largest investment profits typically arise from a molecule with a novel mechanism of action. Essentially, investors reward for innovation rather than duplication. Despite my affinity for tab-cel, I believe that Atara Biotherapeutics (ATRA) has two wildcards with a disruptive mechanism of action that can galvanize the company's prospects.

Specifically, ATA-188 and ATA-190 are designed as silver bullets for the dread condition (multiple sclerosis). They attack multiple sclerosis as if the disease is of viral origin rather than autoimmune. This is in stark contrast to the conventional paradigm that multiple sclerosis is strictly autoimmune. As such, I believe that any positive news on this front will induce a vigorous rally. In this research, I'll present a fundamental analysis of Atara while focusing on the multiple sclerosis franchise.

Figure 1: Atara chart (Source: StockCharts)

Figure 1: Atara chart (Source: StockCharts)About The Company

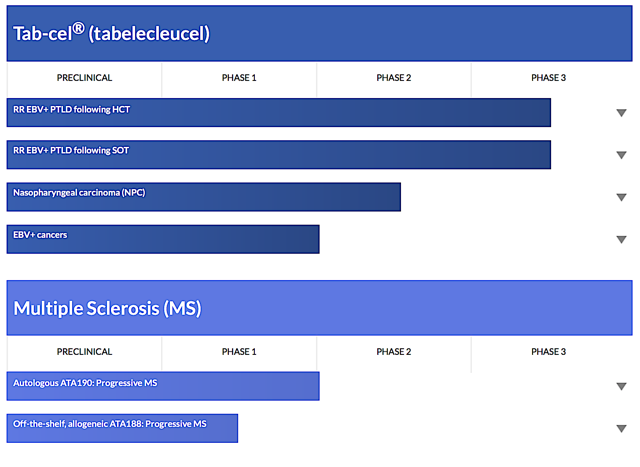

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in San Francisco California, Atara is focused on the innovation and commercialization of allogeneic T-cell immunotherapies (“A-TCI”) to serve the strong unmet needs in cancer and autoimmune diseases. Since A-TCI functions similar to a CAR-T, it activates the most important cells of the immune system (i.e. T-cells). I noted in the prior research,

Instead of engaging CD4 (helper T-cells), A-TCI primes CD8 (killer) T-cells with intelligence to improve these cells’ adeptness at detecting and destroying cancers and virus. Powering by A-TCI, Atara is growing a robust pipeline of immunotherapies. The partnership with Memorial-Sloan Kettering (MSK) also enabled Atara to deliver the next-generation mesothelin-targeted CAR-T (i.e. MT-CART).

Hopes For Multiple Sclerosis

On June 29, 2019, Atara announced that the company presented the Phase 1 safety data of ATA-188 for multiple sclerosis ("MS") at the 5th Congress of the European Academy of Neurology (EAN) in Oslo Norway. As an autoimmune disease, MS incites the body's natural defense system to go "haywire" and thereby attacks normal tissues. In this case, the central nervous system ("CNS") that include brain and spinal cord are at the mercy of the immune system.

As the CNS that controls the functioning of other organs are decimated, MS patients suffer from a plethora of manifestations. They include tingling, numbness, pain, spasm, weakness, dizziness and other problems relating to vision, balance, and cognition. Sexual dysfunction and bladder issues are also common.

Accordingly, patients are diagnosed based on physical manifestations with a supporting CNS scan. The mainstay treatments are steroids and immunosuppressants to calm down the immune system. Nonetheless, there is a strong demand for novel treatment due to the adverse effects of the aforesaid standard of care. It's worthwhile to note that current MS therapies do not modify the disease course. Patients will ultimately succumb to this debilitating disease.

Notably, my journey in learning about MS commenced in medical school. My interest is heightened because MS took the life of a charismatic Vietnamese singer, Ngoc Lan. As if a green leaf died for no reason, MS suddenly rocked the Vietnamese community as it robbed her life. In medical school, I learned that the hallmark of an autoimmune disease like MS is when the immune system attacks itself. At the time, it didn't make sense why the body would ravage itself.

Over the years, it dawned on me that there is no mistake in our physiologic design and function. In her infinite wisdom that is tested by Natural Selection, Mother Nature embodies perfection in design. In my view, the disease manifestations of MS are simply byproducts of something else like a "virally jacked" event. After all, Mother Nature is not foolish to design an immune system that will self-destruct the species.

Figure 3: Ngoc Lan (Source: VietCeleb)

Figure 3: Ngoc Lan (Source: VietCeleb)

As MS is a devastating condition without a disease-modifying treatment, ATA-188 can change this treatment landscape due to its differentiated mechanism of action. Instead of knocking out the immune system with steroids and immunosuppressants, ATA-188 targets Epstein-Barr Virus (EBV) that is believed to incite our immune system. This is a highly refined therapeutic approach due to its excellent safety profile. Moreover, the high specificity confers an improved efficacy.

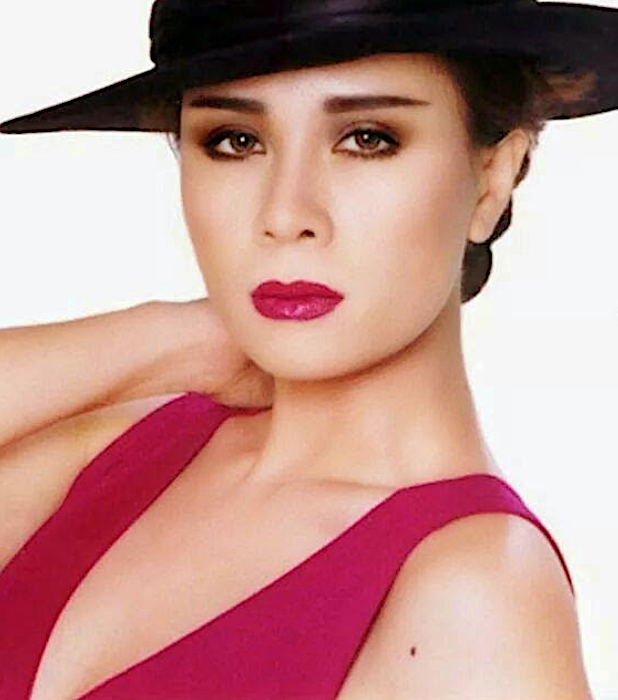

It can be difficult to wrap your mind around the fact there are viral elements that remain dormant in our DNA. Altogether, these elements are comprised of a significant portion of the "junk DNA." As a misnomer, junk-DNA is not "trash." If you dig deeper into their origin, these genetic blueprints have interesting origin and function.

For instance, when an RNA virus attacks a host its RNA is integrated into the genes as DNA. And, it'll remain dormant inside the DNA prison as endogenous retrovirus for the rest of the host's life. Under stressful physiologic conditions like unhealthy eating or illness, the virus emerged as cold sores, etc.

Figure 4: Junk DNA (Source: ScienceDaily)

Figure 4: Junk DNA (Source: ScienceDaily)

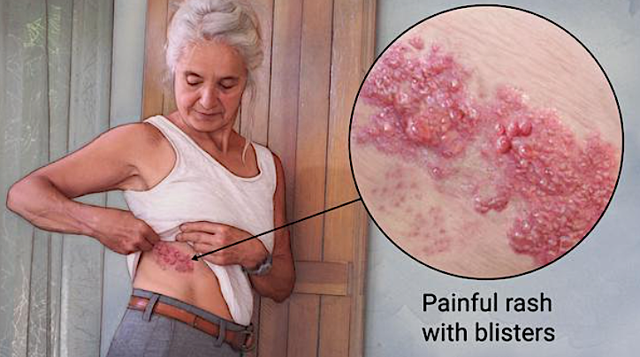

When the virus that resides in our ganglion cells become activated, the painful skin condition dubbed shingles develops. With shingles, the patient simply ends up with the usual fever and an extremely painful rash that occurs along a skin area known as a dermatome. As the herpes virus that causes shingles only remains in somatic cells, shingles is not passed to the next generation. Now the special situation occurs as the hijacker takes residence in our germ cells (i.e. eggs/sperms), its genetic elements will be transferred to the host's descendants.

Figure 5: Shingles (Source: Mayo Clinic)

Figure 5: Shingles (Source: Mayo Clinic)

Over millions of years of evolution, the virus surface as non-expressing genetic elements in our DNA. You might ask why do virus not induce a full-blown disease? Well, the "General T cells" of the immune systems go on his night watch to keep virus and foreign invaders at bays. Over the years, the viral genes are also extensively damaged that they might lose a promoter or other molecular switches needed for reactivation.

Between here and there, some rogue viral fragments evolved and thereby breaks free from the prison of our DNA. I view this phenomenon that explicates MS as the character named T-Bag in Prison Break. As T-Bag breaks free, he'll trip the guards to go on a chase of their life.

Figure 6: T-bag (Source: Express)

Figure 6: T-bag (Source: Express)

And due to the extensive changes and adaptation to our DNA, the endogenous virus now appears similar to our genetic elements and tissues. As such, they carry both viral and normal cellular markers. In a twist of fate, our immune system now views the virus as both "self and non-self." Consequently, the prison guards (i.e. immune cells) are confused and bewildered.

In carrying out their duties, the guardian cells attack mutated viral elements as well as normal cells. For MS, the immune system takes its wrath against brain tissues and spinal cord. And, the fact that the MS viral flares comes and goes explain the ebbs and flows of symptoms. Though symptoms are transient, MS wreaks havoc on these patients. For many unfortunate souls like the young singer Lan, the disease ultimately robbed their life.

Though what I presented is out of the box thinking, there is proof in the pudding for this novel school of thought. For instance, EBV footprints are found abundantly in MS patients. Prominent scientists are starting to believe the viral origin of autoimmune conditions. Riding this wave of scientific advancement, I believe that ATA-188 is going to lock EBV back in the DNA prison to restore the physiologic balance. And, I'm highly encouraged that early ATA-188 data supports good tolerability. That'll be a major advantage of ATA-188 over steroids/immunosuppressants.

Looking ahead, Atara intends to present initial efficacy results for the first cohort in 2H2019. Despite the sound underlying science, I still believe that the MS franchise is a "wild-card." As a doctor and scientist, I prefer to have more clinical evidence before staking my conclusion. In capturing the essence of the MS franchise, I elucidated,

With sound underlying fundamentals, there is a good chance for ATA-190 and -188. Asides from steroids and immunosuppressants, there is no other treatment option for MS. Current MS treatment have notorious side effects. As such, the demand for novel treatment is so strong that market bulls want to jump out of the gate like synchronized swimmers about to take a dive. If Atara can garner positive results for its MS portfolio, this stock should be worth at least several billion dollars higher. After all, the MS market is appraised at least $21B in 2016. And, it's growing at a rapid pace.

Financial Assessment

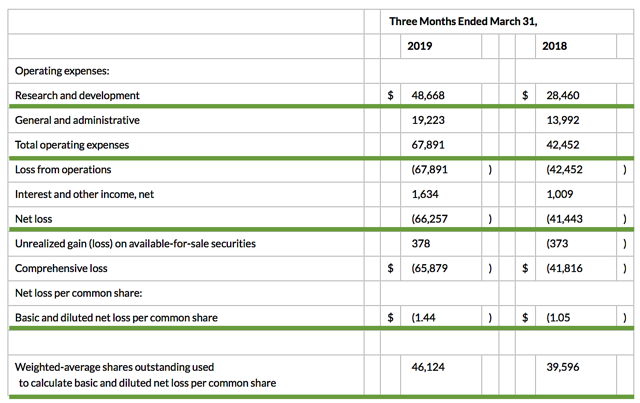

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." That being said, I'll analyze the 1Q2019 earnings report for the period that concluded on March 31. However, this will be a quick assessment because I already covered financial analysis in the prior article.

Accordingly, the research and development (R&D) registered at $48.7M compared to $28.5M for the same period a year prior. The bulk of R&D expenses were attributed to the development of ATA-188 and tab-cel. I view the 70.8% year-over-year (YOY) R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. You have to plant a tree today to enjoy its fruits.

That aside, there were $66.3M ($1.44 per share) net losses versus $41.4M ($1.05 per share) decline for last year. The 31.4% bottom-line depreciation is due to higher R&D and other corporate expenses. Regarding the balance sheet, there were $237.5M in cash, equivalents, and investments. Based on the $67.8M quarterly operating expense (OpEx) rate, I calculated that there are adequate capital to fund operations into year-end prior to the need for additional offerings.

Excessive offerings can dilute the shares count so let's check the dilution rate. As the shares outstanding increased from 39.5M to 46.1M for Atara, my rough arithmetics yield the 16.7% dilution. At this rate, Atara easily cleared my 30% dilution cutoff for a profitable investment. Hence, this company is most definitely not a serial diluter.

Figure 7: Key financial metrics (Source: Atara)

Figure 7: Key financial metrics (Source: Atara)Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. Moreover, the risks are growth-cycle dependent. At this point in its life cycle, the main concern for Atara is if tab-cel can post strong data and thus gains conditional approval first and full approval later. Given that tab-cel is the leading franchise, the stock will likely tumble over 70% in case of a negative clinical binary and vice versa. Though there is always a chance of negative data, I believe that tab-cel will deliver good outcomes due to the robust prior results. As such, I ascribed a 35% chance of clinical failure for tab-cell.

The other risks pertain to the clinical reporting of its CAR-T and MS franchises. In case of a trial failure, the stock won't lose as much value because they are not the crown jewel. That aside, there is the concern that Atara might grow aggressively and thereby runs into the potential cash flow constraint. The departure of top-level management could also foretell fundamental depreciation.

Conclusion

In all, I upgraded Atara Biotherapeutics from a hold to a buy with the four out of five stars rating. Atara is powered by tab-cel, highly advanced immunotherapy that harnesses the power of T cells. Though I expect tab-cel to procure excellent results, I believe that Atara is shifting toward CAR-T. The recent partnership expansion with MSK is the first evidence. The entry of the CAR-T Titan (Dr. Pascal Touchon) is another prima facie. As I prefer the former leadership (Drs. Isaac Ciechanover and Dietmar Berger) to remain, corporate politics dominate.

Amid these catalysts, I'm quite interested in the upcoming efficacy data of ATA-188 for the MS franchise. If the results prove positive, this asset will certainly be worth several billion dollars and thereby induces an acquisition. Larger pharmaceutical companies are always on the search for novel medicine. And, ATA-188 and ATA-190 are as advanced as it gets for MS. Last but not least, it can be difficult to stomach the volatility in Atara but having a strong stomach usually lead to outsized returns.

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest… I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.