Summary

Though not exhilarating, value and growth investing usually garner outsized returns. Nonetheless, it takes time for the value of growth equity like ArQule to be unlocked.

After years of dormancy, Arqule bulls rallied to the strong clinical reporting of ARQ-531 for various blood cancers. And, I forecast that advanced trials will deliver positive results.

In honoring my father, I'm offering a 50% membership discount to new subscribers. Message me if you'd like to receive your Father's Day.

Time is the friend of the wonderful company, the enemy of the mediocre. - Warren Buffett

Author's Note: In honoring my father, I'm offering a 50% membership discount to new subscribers. Message me if you'd like to receive your Father's Day gift.

Aside from his prowess for numbers, Warren Buffett has the excellent temperament for investment. In my view, Buffett's mega success is the cumulation of his hard work and rigorous learning. With a voracious appetite for knowledge, Buffett read financial report daily in his office. The man is a learning machine. That aside, the fact that Buffett lives in the golden land of opportunity also helps him grow Berkshire Hathaway (BRK) to become a multibillion-dollars franchise. In following the footsteps on the giant Buffett, I made it a habit to exercise my due diligence by researching every day and periodically reviewing my investment thesis. This learning process reinforces my growth and value investing approach that is adapted specifically for the life science industry. Over the years, I'm convinced that the Buffett wisdom - time being on your side when you hold a fundamentally sound stock - is true. As such, my pick on the oncology innovator ArQule (ARQL) exemplifies the Oracle's teaching.

Aside from his prowess for numbers, Warren Buffett has the excellent temperament for investment. In my view, Buffett's mega success is the cumulation of his hard work and rigorous learning. With a voracious appetite for knowledge, Buffett read financial report daily in his office. The man is a learning machine. That aside, the fact that Buffett lives in the golden land of opportunity also helps him grow Berkshire Hathaway (BRK) to become a multibillion-dollars franchise. In following the footsteps on the giant Buffett, I made it a habit to exercise my due diligence by researching every day and periodically reviewing my investment thesis. This learning process reinforces my growth and value investing approach that is adapted specifically for the life science industry. Over the years, I'm convinced that the Buffett wisdom - time being on your side when you hold a fundamentally sound stock - is true. As such, my pick on the oncology innovator ArQule (ARQL) exemplifies the Oracle's teaching. Figure 1: Arqule stock chart. (Source: StockCharts)

Figure 1: Arqule stock chart. (Source: StockCharts)

From 2016 to early 2018, the shares were trading at a depressed level, around $1.5 per share. During the time, I realized that there is much room for growth ahead due to the quality of its molecules. And, I was even more excited because ArQule was undergoing a period of market unpopularity. Consequently, it enabled the stock to trade at a deep bargain to its true worth or intrinsic value as Buffett calls it. In just over a year, ArQule has appreciated over 37%. Despite the modest gains, the best is yet to come. In this article, I'll present a fundamental analysis of ArQule and provide my expectation on this young grower.

About The Company

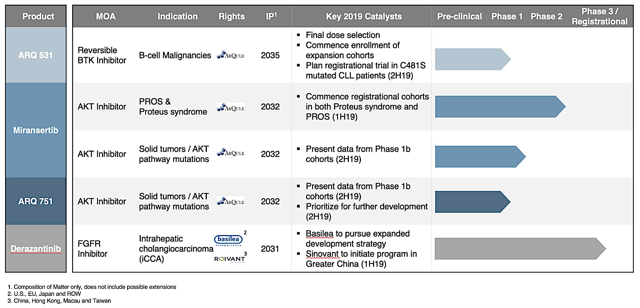

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in Burlington Massachusetts, Arqule is focused on the innovation and commercialization of precision medicine to serve the unmet needs in oncology. Harnessing the power of various tyrosine kinase medicines, Arqule is brewing a robust pipeline of three molecules (ARQ-531, miransertib, and ARQ-751) for various cancers.

Derazantinib

Viewing derazantinib as a golden nugget, Basilea and Roivant acquired the rights to this promising molecule. Thereafter, they are investigating its efficacy and safety is a Phase 3 registration trial for a liver cancer known as intrahepatic cholangiocarcinoma. I believe this is good for ArQule because the company received payments to fund its pipeline innovation.

Similar to an infant, it's important for a young company like ArQule to focus on walking first prior to running. Hence, it is much profitable to devote the efforts on a few key assets (i.e. low hanging fruits) rather than shotgunning everything. If there is plenty of cash from a partner, then why not? Nonetheless, shotgunning is not a prudent strategy for ArQule because doing can burn a hole in the balance sheet. That being said, let's shift gears to analyze the crown jewel (ARQ-531).

Phase 1 Trial Of ARQ-531

On June 14, 2019, Arqule published the robust clinical outcomes for the flagship reversible BTK inhibitor (ARQ-531) at the 2019 European Hematology Association (EHA) that was held in Amsterdam Netherlands. In Phase 1 dose-escalation study of patients suffering from resistant blood cancers, ARQ-531 demonstrated excellent efficacy and a favorable safety profile. Per trial design, patients were stratified into eight different groups consisting of lymphocytic leukemia (CLL), small lymphocytic leukemia (SLL), Richter’s Transformation, Waldenstrom macroglobulinemia, and other B-cell Non-Hodgkin lymphomas.

... You can access the full article by clicking here.

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: As a medical doctor/market expert, Dr. Tran is not a registered investment advisor. Despite that we strive to provide the most accurate information, we neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. We reserve the right to make any investment decision for ourselves and our affiliates pertaining to any security without notification except where it is required by law. We are also NOT responsible for the action of our affiliates. The thesis that we presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. Our articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.