I share with you tips on your investment research and monitoring.

Placing your stocks into their appropriate categories helps you to monitor them better.

Categories include growth, stalwart, value, asset, and turnaround.

Make sure you follow the stories in each respective classification and place companies into new categories as the story changes.

Either holding or averaging down during this biotech bear market would lead to lucrative gains in the next bull market cycle.

bombermoon/iStock via Getty Images

Such a study indicates that the greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits far more than the industry as a whole. It further shows that when we believe we have found such a company we had better stick with it for a long period of time. It gives us a strong hint that such companies need not necessarily be young and small. Instead, regardless of size, what really counts is a management having both a determination to attain further important growth and an ability to bring its plans to completion. - Phillip Fisher (Warren Buffett's mentor)

Dear Investors,

To assist you in tracking your stocks, I want to share with you various strategies for classifying your investment into thesis, stories, or categories. That way, you would be more organized and methodical in your investment approach. In my view, being more organized leads to higher returns.

What exactly is an investment thesis?

As you can see, an investment thesis is essentially a story of why you invested in a particular company. Asides from gurus like Warren Buffett, Benjamin Graham, Charlie Munger, Phillip Fisher, John Templeton, etc., I studied Peter Lynch's work. As you can tell, I got this inspiration from Peter Lynch.

Accordingly, Peter Lynch recommended investors write down the investment story for each of their holdings. Back when he was running his fund, Peter Lynch would write down the stories for his universe of thousands of stocks. As for you, I highly recommend that you keep track of your own in this simplified way. Additionally, be sure to utilize all the resources that I provide to you inside IBI.

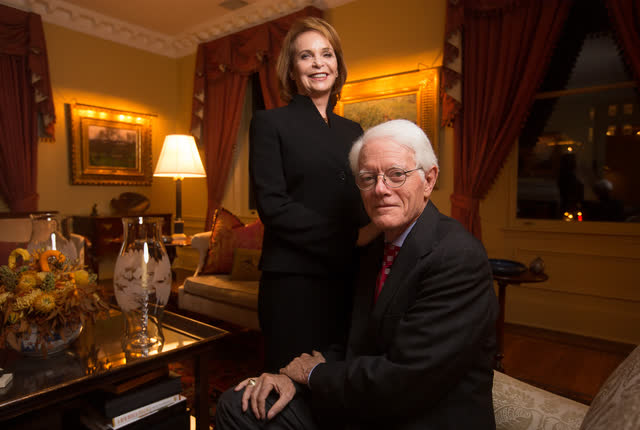

Figure 1: Peter Lynch and his wife Carolyn

Asset Plays

Shifting gears, let's talk about the various investment categories, thesis, or stories. As you can tell, placing your stocks into various categories give you a quick and easy way of understanding your different holdings. One such category is an "asset play."

Here, the company has something valuable (maybe, real estate) that is overlooked by the market. For biotech innovators, an asset could be a technology platform or an upcoming blockbuster. To track this story, you want to make sure that the company would unlock the value of its assets over time. One way is to out-license them to other firms. Another way is to form a partnership.

Growth Stocks

As you can appreciate, a growth stock would increase many folds over the decades if you keep it for the long haul regardless of the market cycles. Peter Lynch called such a stock that delivers several folds a "multi-bagger" stock. Given that I'm into generating the most massive growth, my main focus has been on growth stocks.

In following these stocks, you want to see the company continues to advance its pipeline. As a biotech stock gained marketing approval, you want to make sure the company can continue to deliver increasing revenues. For a young grower, just focus on top-line (i.e., revenue) growth. You won't see the positive bottom line (i.e., net earnings) until years later.

Stalwart Stocks

About "stalwart" stocks, these were once young growers that have now surpassed their most aggressive growth phase. As a stalwart, this company would still give you more upsides. Nevertheless, you can expect typically less than 50% in a stalwart.

If the company is paying dividends, you want to make sure it continues to do so. At the same time, you want the company to continue executing its current business model. Don't expect extremely robust growth here.

Bargain (i.e., Value) Equities

Now, I believe that you are most familiar with bargain (i.e., value) stocks. After all, they are popularized by Benjamin Graham's disciples. One of whom is Warren Buffet. As you can tell, bargain plays are often large blue-chip equities. And, value comes into play when there is a mismatch between the stock's true worth (i.e., intrinsic value) and the market valuation (i.e., the share price). A prime time for you to find many bargains is during a bear market, in which there is plenty of value (or bargains around).

As you purchased these stocks, you want to follow up to see if the share price appreciates beyond the stock's true worth. After the value is exhausted, you can consider selling the equity.

Turnaround Stories

Asides from growth equity, you can also find multi-baggers in turnaround stocks. Companies in this category are beaten up beyond recognition. Usually, a turnaround stock is suffering from previous debacles. For biotech, a turnaround company typically has very few drugs in its pipeline. And, the company usually received a complete response letter (i.e., CRL) from the FDA for its lead medicine (i.e., the crown jewel of the pipeline). These stocks have extremely high risks. However, they tend to appreciate highly aggressively if they are showing strong turnaround progress.

On that note, you want to make sure the management follows through with their turnaround plans. Importantly, be sure these companies have a strong cash position for the turnaround.

Multiple Categories

Keep in mind, that a company can be in several categories at once. For instance, you can have a growth/asset play. As the company evolves, the story also changes. That is to say, a successfully turned around company can become either a value play or a growth story, etc.

Taking Profits

While Peter Lynch recommends that you sell (i.e., take profits) after a stock successfully turnaround (or when it transitions into the next category), I prefer to hold a stock indefinitely like Buffett. As long as there are more value and growth, I would continue to hold. My variation is to take profits on 50% of the shares while letting the rest ride indefinitely.

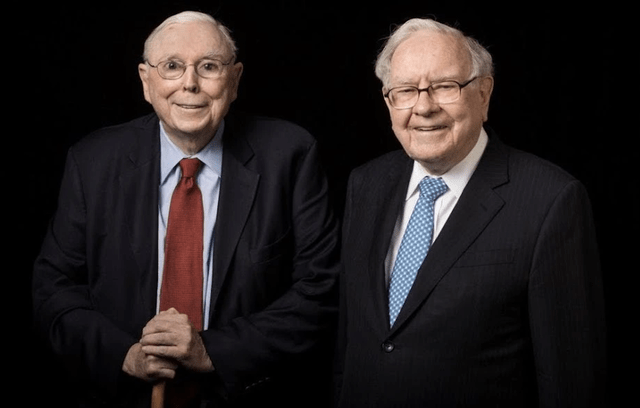

Figure 2: Warren Buffett and Charlie Munger

Final Remarks

As you're writing your investment stories for various stocks, make sure you keep the story as clear and as concise as possible. The more clarity the better it is for you to follow. That aside, I want to remind you that you should not let this bear market gets to you. Contrary to conventional wisdom, now is your golden opportunity.

As usual, I'd like to remind investors that the choice to buy, sell, or hold is always yours to make. In my view, you should overcome your FEAR that is False Expectations Appearing Real to either hold your fundamental stocks "as is" or to average down some more. In doing so, you position yourself for lucrative profits at the upturn of the next bull market cycle.

If you're interested in reading my in-depth biotech investment research and having access to all my services, check out Integrated BioSci Investing at Seeking Alpha.

To Your Success In Life And In Investing,

Dr. Harvey Tran

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I'm not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I'm also NOT responsible for the action of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized. That aside, I'm not giving you professional medical advice. Before embarking on any health-changing behavior, make sure you consult with your own doctor.