Summary

Monitoring pharmaceutical-partnership is a prudent strategy to assess the underlying value of a platform technology.

Due to its stellar CRISPR/Cas9 platform, CRISPR Therapeutics is able to expand its collaborative relationship with the pharmaceutical elite, Vertex.

Leveraging CRISPR's expertise, Vertex is marching into the lands of gene-editing to galvanize medicines for Duchenne Muscular Dystrophy and Myotonic Dystrophy Type 1.

To honor of my Father, I'm giving out a 50% discount gift to new members this weekend in advance of next week's Father's Day.

All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies. - Warren Buffett

Author's note: In honor of my Father, I'm offering new subscribers a 50% discount gift in advance of next weekend's Father's Day. Send me a message if you wish to receive yours.

If you look at a fruitful marriage, chances are that the house is filled with joy and laughter. In bioscience investment, the pursuit of happiness also comes from partnership and acquisition. And, there is an aplenty of partnership to drive the common goal of delivering hopes for patients while reaping profits for shareholders. That being said, the most transcending situation occurs when a partner doubled down its initial commitment. In my view, there has to be something like an invaluable technology platform that enticed the partner. Consequently, I believe that this situation usually leads to an outright acquisition.

The prime example of the aforesaid phenomenon is the union between Vertex Pharmaceuticals (VRTX) and CRISPR Therapeutics (CRSP). Due to the partnership expansion, CRISPR shares appreciated 15% today and thereby procured a 119% profits for my Core Portfolio Alpha. Nonetheless, the best is yet to come. In this research, I'll present a fundamental analysis of CRISPR while focusing on partnership expansion.

Figure 1: Crispr stock chart (Source: StockCharts)

Figure 1: Crispr stock chart (Source: StockCharts)About The Company

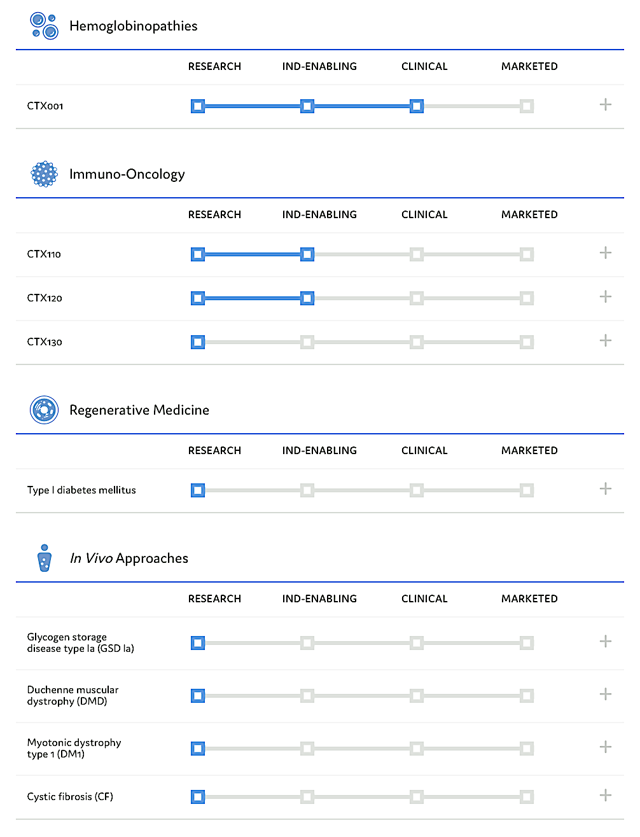

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Based in Switzerland, CRISPR Therapeutics is focused on the development and commercialization of gene-based therapies to serve the unmet needs in blood disorders, immuno/oncology conditions, and regenerative medicines. On the shoulders of its stellar gene-editing platform dubbed CRISPR/Cas9, CRISPR set out to make history. In a two-pronged approach, the firm is nourishing a highly promising portfolio of gene-editing medicines and CAR-T therapeutics.

As it galvanizes the next-generation gene-editing medicines, CRISPR attracted the attention of Vertex. In unison, the partners are developing up to six CRISPR/Cas9-based molecules. Nevertheless, CTX-001 is simply the first prodigy child in this harmonious union. But there is much more to come, as shown in the deep pipeline below.

Expanding Vertex Collaboration

Shifting gears, let's look at CRISPR's incoming fortune through the Vertex partnership expansion. Regarding pharmaceutical partnership, I notice that most relationship simply remains stagnant. A more promising situation occurs when the couples deepen their existing collaborative terms. If the development proves fruitful, the large company would make further commitment to take the small partner under its wings. Under the aforementioned dynamics, the relationship between CRISPR and Vertex is flourishing.

On June 06, 2019, Vertex announced its upcoming conquest into gene-editing as the company seeks to innovate novel medicines for the orphan diseases coined Duchenne Muscular Dystrophy (DMD) and Myotonic Dystrophy Type 1 (DM1). Of note, investment into orphan disease strategic because an orphan drug can be reimbursed on an average of $140,000 annually. The reimbursement is warranted to encourage the innovation process. After all, pharmaceutical innovation is a lengthy process that is fraught with a high rate of failure.

As it is committed to bringing hopes to patients suffering from orphan diseases, Vertex deepens its relationship with CRISPR while concurrently bought out the private gene-editing company, Exonics Therapeutics. It seems to me that Vertex just "doubled down" on CRISPR and orphan drugs. Consequently, the deal signaled an incoming tide of fortune for CRISPR shareholders.

... You can access the full article by clicking here.

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: As a medical doctor/market expert, Dr. Tran is not a registered investment advisor. Despite that we strive to provide the most accurate information, we neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. We reserve the right to make any investment decision for ourselves and our affiliates pertaining to any security without notification except where it is required by law. We are also NOT responsible for the action of our affiliates. The thesis that we presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. Our articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.