Summary

Last weekend, I featured Part I of the Top Picks for Summer 2019. I'll finish up this series by presenting four more growth companies.

As a leader in the non-alcoholic steatohepatitis space, Madrigal is most likely to deliver strong advance data and thereby takes its crown as the undisputed champion in the $25B market.

To honor of my Father, I'm giving out a 50% discount gift to new members this weekend in advance of next week's Father's Day.

One thing that could help would be to write down the reason you are buying a stock before your purchase. Force yourself to write this down. It clarifies your mind and discipline. - Warren Buffett

Author's note: In honor of my Father, I'm offering new subscribers a 50% discount gift in advance of next weekend's Father's Day. Send me a message if you wish to receive yours.

In Part I of my Top Picks For Summer 2019, I featured four powerful bioscience growth equities. To complete this summer expedition, I recently came out of the jungle of bioscience equities to deliver to you four more intriguing investment leads. In my view, they are low hanging fruits that can catapult your portfolio to the new high, provided that you hold them for the next several years. In my view, the most outsized returns arise from long-term investing.

If you take equity investment similar to buying a house, it'll make much more sense. One cannot expect to flip a house overnight for the most gargantuan profit. A house needs years to appreciate multiple folds. From the fundamental paradigm, equity investment works pretty much the same way. Time is simply a requisite for a growth business to unlock its full potential. Buffett said it best: "You can't produce a baby in one month by getting nine women pregnant."

My view is in line with the Oracle of Omaha, Buffett. Nevertheless, I believe that you can still bank short-term profits in bioscience. This occurs in situations known as "binary events" like an FDA approval or clinical data reporting. Nonetheless, one needs to have expert forecasting skills to have an edge over the market. Armed with all the arsenals, it's still quite risky. Moreover, the returns are not outsized as in ultra-long-term holding to make investing worthwhile.

A prime example that illustrates my assertion is Jazz Pharmaceuticals (JAZZ). Back in 2019, I learned about Jazz from my friend, Mr. Xiong. We've been good friends for over a decade. Our friendship commenced in college when we just got our feet wet into equity research. I remember we used to go to those option seminars. At the time, Jazz was trading around $1.0 per share. As we had a myopic view during the time, we sold out early for a good profit.

Over the years, our initial satisfaction turned into distraught as Jazz continues its ascension to the height of Mount Everette. Hindsight is always 20/20. And yet, had we hold Jazz through thick and thin, it would have been a 130-bagger investment. Another example is Sesen Bio (SESN). If you sold out Sesen prematurely, you would have missed a 100% rally this year. As I learned my lesson from Jazz, I harped at investors to build shares of Sesen when it tumbled early in the year. The story on Jazz and Sesen reinforced the need for investors to adopt a long-term approach. If you are into trading, I suggest you trade on a separate portfolio to keep things compartmentalized. That way, your stocks won't get mixed up.

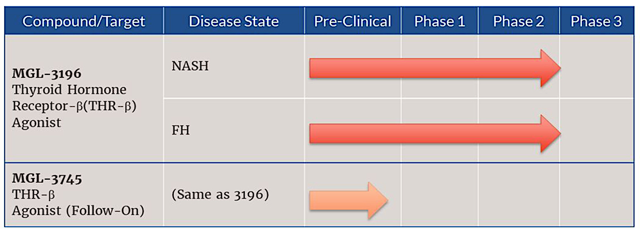

Shifting gears, I'll feature the first growth equity that made our list in Part II, Madrigal Pharmaceuticals (MDGL). After a successful merger with a private company, Synta Pharmaceuticals back in 2016, Madrigal has an aplenty of cash to power its drug development to serve the unmet needs in the $25B non-alcoholic steatohepatitis ("NASH") market. At the same time, Synta is bailed out from its subpar clinical reporting for other developments. As a beta-thyroid agonist with specificity toward the liver, the lead molecule MGL-3196 posted the robust Phase 2 trial results.

Figure 2: Therapeutic pipeline (Source: Madrigal)

Figure 2: Therapeutic pipeline (Source: Madrigal)

In the aforesaid investigation, MGL-3196 demonstrated statistically and clinically meaningful liver fat reduction as well as NASH resolution on biopsy. As such, I strongly believe that it'll generate similar results in the Phase 3 trial and thus positioned to gain approval. Due to the substantial (42%) fat reduction at the high dose, MGL-3196 is best positioned to treat early-stage NASH.

Ultimately, Madrigal will capture the pristine mega-blockbuster NASH market. Despite the meager 15% profits for IBI Core Portfolio ("CP Alpha"), I strongly believe that this stock will become a multibagger in the long-run. And, I ascribed a 65% "investment profitability" score on this stock. In other words, you're most likely to make big money on Madrigal in the next couple years as its data matures.

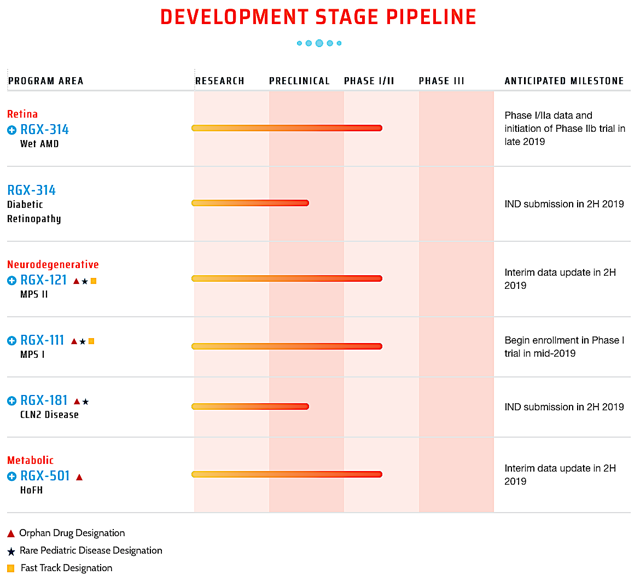

Next off the bat is a leading in gene therapy innovator known as Regenxbio(RGNX). I prefer to invest in leaders in their respective field because they usually post robust clinical outcomes. As the positive data rolls in, the stock usually garners huge profits. That being said, the proprietary platform technology for gene delivery coined NAV is essentially the heart of Regenxbio. Born out of Dr. James Wilson's Lab at the University of Pennsylvania, NAV is the prodigy child of the cumulative wisdom learned from previous setbacks in gene transfer. Accordingly, NAV employed highly advanced adeno-associated virus (“AAV”) delivery vectors that overcame previous obstacles.

Figure 3: Therapeutic pipeline (Source: Regenxbio)

Figure 3: Therapeutic pipeline (Source: Regenxbio)

Due to its excellent clinical outcomes, over ten different companies tapped into Regenxbio for NAV. And, they're currently developing NAV for over 20 different indications. A notable partner, AveXis was acquired by Novartis for $8.7B last year. With AveXis under its wings, Novartis successfully expedited for the development of Zolgensma. On May 2019, the aforesaid gene therapy is approved for the orphan condition spinal muscular atrophy Type 1.

Asides from the strong prospects in the licensee programs, I expect the crown jewel, RGX-314 to realize its mega-blockbuster prospect in the coming years. Currently in Phase 1/2 for wet age-related macular degeneration ("AMD"), RGX-314 has a 65% (more than favorable) chance of delivering good clinical results. As such, it'll cut into the $20.7B market wet AMD market. Though Regenxbio has registered over 50% profits for CP-Alpha, I believe that there are multiple folds upsides. And, I ascribed a 65% investment profitability to this innovator.

... You can access the full article by clicking here.

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest … I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: As a medical doctor/market expert, I'm not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I'm also NOT responsible for the action of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investing in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your action. You should also consult with your own financial advisor for specific guidance, as financial circumstance are individualized.