Summary

In recent years, stellar breakthroughs such as CAR-T and gene therapies painted the bioscience landscape.

Previously limited by expertise, we're witnessing an increasing number of companies brewing gene-editing molecules.

Precision medicine therapeutics and companion diagnostics are powering the next wave of innovation.

Nonetheless, the China Trade War and drug pricing pressure lead bioscience stocks to exchange hands at a deep discount.

At the turn of the next market cycle, the long-term oriented investors will enjoy sizable profits.

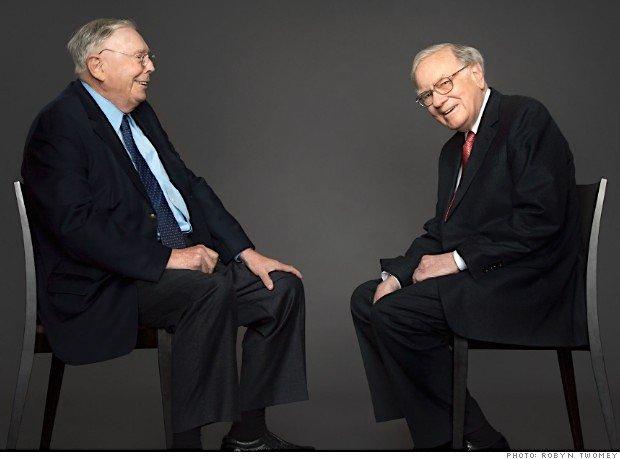

I like the idea of using artificial intelligence because we're so short of the real thing. - Charlie Munger

I hope that you guys had a great weekend. Asides from doing light tasks like posting on my social media, I shifted away from work during the weekend. In my view, it's best to conduct investment research and news analysis during weekdays. As family and God are matters of the heart, they should at least have the weekend. I believe it's more healthy and balance for you to reserve the weekend to rejuvenate and improve other arenas of life. After all, there is more to life than investing. And, the investment process is not a sprint. It's a marathon so pace yourself accordingly.

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

That being said, I'd like to kick off the week with another series coined Market Insight. This publication is similar to the Industry Trends analysis that I conducted from time to time. Despite the resemblance, there are significant differences. Specifically, Market Insight explores current affairs that are driving broader market behaviors. Aside from providing you with the intelligence affecting your investment value, Market Insights offers various strategies to help you capitalize gains and minimize losses.