Summary

In recent years, stellar breakthroughs such as CAR-T and gene therapies painted the bioscience landscape.

Previously limited by expertise, we're witnessing an increasing number of companies brewing gene-editing molecules.

Precision medicine therapeutics and companion diagnostics are powering the next wave of innovation.

Nonetheless, the China Trade War and drug pricing pressure lead bioscience stocks to exchange hands at a deep discount.

At the turn of the next market cycle, the long-term oriented investors will enjoy sizable profits.

I like the idea of using artificial intelligence because we're so short of the real thing. - Charlie Munger

I hope that you guys had a great weekend. Asides from doing light tasks like posting on my social media, I shifted away from work during the weekend. In my view, it's best to conduct investment research and news analysis during weekdays. As family and God are matters of the heart, they should at least have the weekend. I believe it's more healthy and balance for you to reserve the weekend to rejuvenate and improve other arenas of life. After all, there is more to life than investing. And, the investment process is not a sprint. It's a marathon so pace yourself accordingly.

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

Figure 1: Charlie Munger and Warren Buffett (Source: Robyn Twomey)

That being said, I'd like to kick off the week with another series coined Market Insight. This publication is similar to the Industry Trends analysis that I conducted from time to time. Despite the resemblance, there are significant differences. Specifically, Market Insight explores current affairs that are driving broader market behaviors. Aside from providing you with the intelligence affecting your investment value, Market Insights offers various strategies to help you capitalize gains and minimize losses.

Accordingly, I'm a firm believer that the biotech industry is an ocean, abundant of investment treasures. It's where you'll find the basic building blocks to create wealth. In the long run, the Nasdaq Biotechnology Index outperformed nearly all market benchmarks. If you have a well-diversified bioscience portfolio, it's a near certainty that you'll reap stellar profits. Just don't expect the gains to occur overnight.

Besides from profits, your investment fosters lifesaving innovation. Like good karma that is flowing continuously, your support circulates hope to countless others and your own family. No matter how healthy you are, there is no guarantee that you won't get sick one day. As such, it's important to ensure that the availability of innovative medicines for us all. Don't let the market chatters dampen your investment profits and hopes.

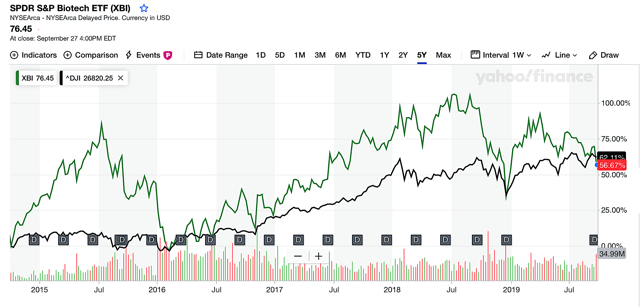

Figure 2: Market performance (Source: Yahoo Finance)

Figure 2: Market performance (Source: Yahoo Finance)

Despite its excellent long-term prospect and investment merits, the biotech sector is strongly affected by high volatility that, in and of itself, is dictated by market sentiment. To gauge the latest mood, let's check out the Barron article (Biotech Roundtable: How to Invest in Medicine’s Future). As follows, I believe that the author (Lauren Rubin) did a fine job of capturing the essence of current market affairs. Rubin explicated,

Recent advances in biotechnology, from data-driven diagnostics to game-changing gene therapies, suggest we’re on the cusp of a golden age in which many feared diseases will become treatable, or even cured. Yet for all the optimism in the lab, pessimism reigns on Wall Street, where investors lately have been yanking money from health-care and biotech stocks and funds. Given a 25% slide in the Nasdaq Biotechnology Index from its mid-2015 peak, the disconnect between a looming scientific revolution and investors’ disillusion has grown too big to ignore.

After having research countless of life science innovators, I arrived at a similar destination as the aforesaid author. From the medical and scientific paradigms, it's truly an amazing point in the History of Time for companies to operate in the bioscience landscape. Innovation is occurring at a phenomenal pace. As such, I painted my research on CAR-T with the same descriptive labeling (i.e. a Golden Age) for the unprecedented developments. Better yet, the stellar cancer treatment (CAR-T) is one of many breakthroughs. Since 2017, we've witnessed the approval of gene therapies, artificial-intelligence diagnostics, and precision medicine. Innovation is occurring at a rapid pace that precision medicine is now becoming an industry standard for managing and diagnosing cancers.

Unfortunately for investors, the shares price of nearly all of the bioscience stocks receded in the deep South. Under rigorous analysis, it's apparent that there is a huge disconnect between the stocks intrinsic value and their market valuation. While no one likes to watch their stocks tumbling, you need to get "comfortable with the uncomfortable feeling." There's no shortcut to the Promised Land of Profits than dealing with adversity and uncertainty. If you're patient, you'll eventually reach your destination to ultimately enjoy spectacular investment success.

Amid declining equities, I usually ask myself two exploratory questions: (1) is the decline is temporary and (2) are the fundamentals of the stocks sound? If the answers are unanimous yes, I'll be ok with the uncomfortable feeling. The reality is that I'll live to see victory. Empowered by my due diligence, I'd add a few more shares on my favorite companies. Through my soul-searching process, I realized the recurring investment theme: appreciate a depreciating stock and it'll appreciate you, provided that the fundamentals are intact.

To put things into proper perspective, your stock's market valuation all depends on the "ebbs and flows" of capital in the financial market. And, this market perception is heavily influenced by short-term outlook and financial news flow. Therefore, whether your stocks rally depend on their ability to attract investors' commitment. Right now, the fear of a drug price regulation spooked bioscience shareholders. Retails and institutional alike are pulling their money out of this niche.

The other culprit dragging down the market is the lingering fear of a prolonged Trade War with the Awakening Dragon China. Like wildfire that ravaged the Amazon rainforest, negative market sentiment spreads quickly through various social media conduits and thereby pummeled fundamentally-sound equities.

Figure 3: Global economy conflict (Source: The Sydney Morning Herald)

Figure 3: Global economy conflict (Source: The Sydney Morning Herald)

As bioscience investors, we've all handed market lemons. And yet, I believe that the most crucial ingredient to making lemonade is lemons. How you make lemonade depends on your investment style and temperament. If you're into flipping stocks for a quick buck, it'd make sense for you to sell out. I make no judgment here, different strokes for different folks.

On the other hand, if value/growth investing is your cup of tea, holding your shares is the logical course of action. I strongly believe that the recent downturn is temporary. It's a matter of when rather than if market stability will be reestablished. Eventually, bioscience stocks will trade much higher than their current value. Time after time, history has proven the existence of market cycles. We're in a down market but that won't last forever.

In the middle of this difficulty, you should purchase more shares of your favorite stocks to capture the opportunity. Notwithstanding, it's important to deter from going "all in" because that's the surest way to go all out of money. It's more strategic to purchase periodically during major hiccups to enjoy a lower average cost. It's important to awaken the courage and insight to either hold or buy when others are selling.

Figure 4: Therapeutic pricing pressure (Source: NYTimes)

Figure 4: Therapeutic pricing pressure (Source: NYTimes)

As usual, I'd like to remind investors that I simply lay out the investment strategy. The choice to buy, sell, or hold is ultimately yours to make. I hope that you enjoy this new Market Insight series. I'll continue to write from time to time to help you put things into perspective during market turmoils. Looking ahead, the ultra-long view is as magnificence as it gets but expects more chaotic times in the near terms. As always, you should work on having a strong stomach to complement your market intelligence. Both are needed for successful investing.

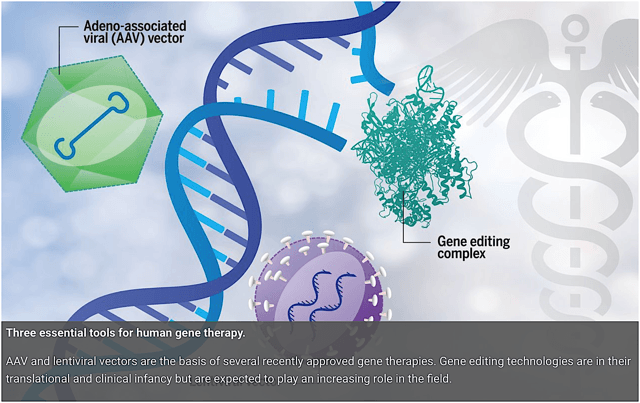

Figure 5: Gene therapy (Source: ScienceMag)

Figure 5: Gene therapy (Source: ScienceMag)

Last but not least, I'll do a portfolio view and update my recommendation this week. If you must have three companies right now, I'd go for Regenxbio (RGNX), CryoPort (CYRX), and Galapagos (GLPG).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, Dr. Tran is not a registered investment advisor. Despite that we strive to provide the most accurate information, we neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. We reserve the right to make any investment decision for ourselves and our affiliates pertaining to any security without notification except where it is required by law. We are also NOT responsible for the actions of our affiliates. The thesis that we presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. Our articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.