Summary

Due to the PillPack acquisition, Amazon will reduce the service demand for traditional brick-and-mortal retail pharmacy.

There is an industry shift favoring mail-order prescription and online pharmacy. Ultimately, it's changing the landscapes for traditional operators like Walgreens and CVS Health.

Under Amazon's gargantuan infrastructure and improved logistics, PillPack will enjoy aggressive business growth. Moreover, it'll launch Amazon's online pharmacy as the initial step for more market domination.

In conveniently offering various medicines in a package, PillPack reduces the complexity of taking drug combination and thereby improves patient convenience.

The theme of investing in logistics providers to capitalize on the growth of another related industry is quite intriguing. This strategy leads to highly profitable returns.

The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective. - Warren Buffett

In supplementing my daily research, I periodically feature other articles in various series for members of Integrated BioSci Investing. My goal is to provide members with additional coverage to synergize my usual in-depth research. In the past, I experimented with the excessive emphasis on series articles. And, I learned that it reduced the quality of Integrated BioSci Investing's usual research. With more wisdom, I'll ensure that these brief analysis solely serve to "enhance" rather than "replace" my core value to our private investment community. Through my work, I seek to empower you in making prudent investment decisions and becoming better investors.

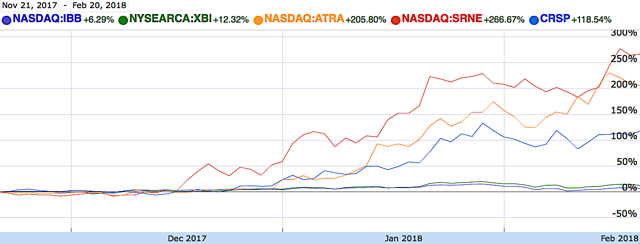

Figure 1: Amazon chart (Source: StockCharts)

Figure 1: Amazon chart (Source: StockCharts)

Though I focus on therapeutic innovation, it's also important for me to assess related business (i.e. retail pharmacy). After all, how innovated drugs are utilized down the vertical chain influences the profitability of bioscience stocks. That being said, I'm intrigued by the recent Amazon (AMZN) acquisition of PillPack. The aforementioned merger and acquisition (M&A) came to my awareness through IBI community discussion.

A notable IBI member shared with the community an article from Christina Farr of CNBC. In my opinion, Farr did a fine coverage of the inside story regarding the Amazon acquisition of PillPack. Instead of solely reading the news, I believe that it's important for you to analyze the information and place them within their appropriate context. In my learning process, I created a "mental framework of data" to make more accurate investment decisions.

My biological analysis machinery is upgraded every time I read up on news and trial results. Consequently, it continually fine-tunes my analytical forecast of clinical trial results and regulatory approvals. And, I want to teach you how to conduct your own analysis rather than simply listening to my recommendation. It's much rewarding to instruct a man how to fish rather than providing him the fish alone.