I share with you tips on your investment research and monitoring.

Placing your stocks into their appropriate categories helps you to monitor them better.

Categories include growth, stalwart, value, asset, and turnaround.

Make sure you follow the stories in each respective classification and place companies into new categories as the story changes.

Either holding or averaging down during this biotech bear market would lead to lucrative gains in the next bull market cycle.

bombermoon/iStock via Getty Images

Such a study indicates that the greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits far more than the industry as a whole. It further shows that when we believe we have found such a company we had better stick with it for a long period of time. It gives us a strong hint that such companies need not necessarily be young and small. Instead, regardless of size, what really counts is a management having both a determination to attain further important growth and an ability to bring its plans to completion. - Phillip Fisher (Warren Buffett's mentor)

Dear Investors,

To assist you in tracking your stocks, I want to share with you various strategies for classifying your investment into thesis, stories, or categories. That way, you would be more organized and methodical in your investment approach. In my view, being more organized leads to higher returns.

What exactly is an investment thesis?

As you can see, an investment thesis is essentially a story of why you invested in a particular company. Asides from gurus like Warren Buffett, Benjamin Graham, Charlie Munger, Phillip Fisher, John Templeton, etc., I studied Peter Lynch's work. As you can tell, I got this inspiration from Peter Lynch.

Accordingly, Peter Lynch recommended investors write down the investment story for each of their holdings. Back when he was running his fund, Peter Lynch would write down the stories for his universe of thousands of stocks. As for you, I highly recommend that you keep track of your own in this simplified way. Additionally, be sure to utilize all the resources that I provide to you inside IBI.

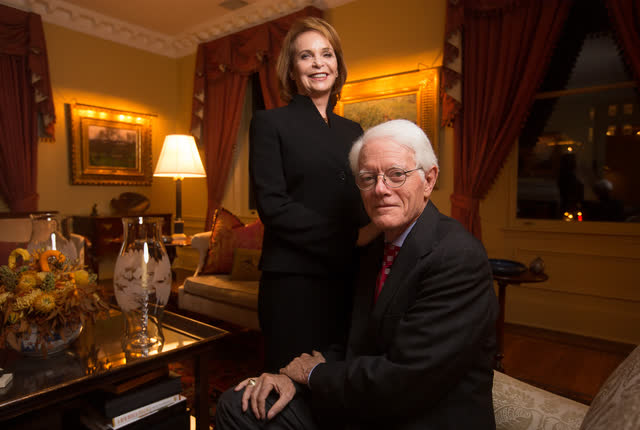

Figure 1: Peter Lynch and his wife Carolyn